In an advanced economy like the United States, a safe and secure housing situation should be attainable for all responsible citizens. Unfortunately, skyrocketing house and rental prices, combined with stagnant wage growth, have created a huge problem: Housing is too expensive for millions of Americans to afford.

Fortunately, various government agencies are working to counter this problem through a patchwork of subsidy programs. National, state, and city governments offer options for low-income housing, rent controls, and other policy tools to help keep housing more affordable.

This article will explain what affordable housing is, how renters can apply for various programs, and how the city and municipal governments can find the resources needed to support their citizens in finding affordable housing.

Measuring “affordable” housing

What is affordable housing, and how do you measure it’s “affordability”?

Many financial planners, as well as the United States government itself, have often used the “30% rule”, which states that housing is affordable when it costs less than 30% of the earnings of a full-time worker. While this rule-of-thumb may be a bit outdated, it’s still the primary measurement of affordability, and it’s often used to guide policy decisions.

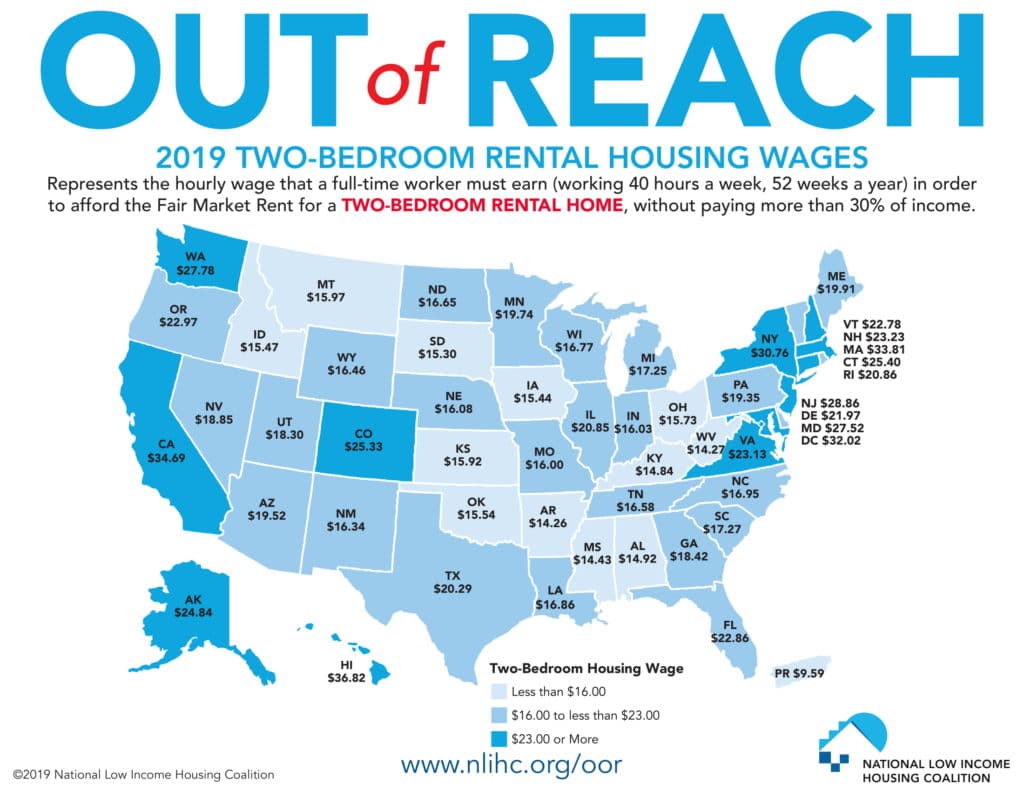

The problem is that, for a huge number of households, rental costs far exceed 30% of income. In fact, a 2019 report by the National Low Income Housing Coalition found that, in order to afford a modest 2-bedroom rental home, renters would need to earn an average wage of $22.96 per hour.

- The actual average hourly earnings of renters nationwide? $17.57.

- The minimum wage for hourly earnings nationwide? $7.25.

The same report found that a minimum wage worker would need to work 127 hours a week (more than three full-time jobs) in order to afford a modest 2-bedroom rental at the government’s own fair pricing standards.

In areas affected by housing booms, such as large cities on the West and East coasts, the problem is even more severe. Workers in California would need to earn $34.69 per hour, for example. The situation in mega-cities like New York and San Francisco are even direr still. The map below compares the scale of the problem across the United States, by listing the hourly wage that a renter would need to earn, 40 hours a week, in order to afford a 2-bedroom rental.

Source: National Low Income Housing Coalition

Illustrating the problem in another way, a report from Harvard University’s Joint Center for Housing Studies found that between 1960 and 2016:

- Inflation-adjusted rents increased by 61%

- Inflation-adjusted home values increased by 112%

- Inflation-adjusted median renter income increased by 5%

- Inflation-adjusted median homeowner income increased by 50%

This means that today’s renters are earning about the same amount that they were in 1960 (adjusted for inflation), and yet their average rents have increased by 61%. And while homeowners are making substantially more in income, they are also hampered by a whopping 112% increase in home prices, adjusted for inflation.

The problems of unaffordable housing

As the graphic above clearly shows, there’s absolutely a problem with housing affordability in the United States. Many families simply cannot afford to rent – let alone buy – an appropriate house or apartment. This creates an obvious problem, with millions of households struggling to pay the bills each month – in some cases, fighting eviction, being forced to move in with relatives, or even joining the ranks of America’s 500,000+ individuals experiencing homelessness.

Beyond the obvious, there are broader issues that arise when housing becomes unaffordable:

- Cities become increasingly expensive, forcing low-wage earners out to the suburbs to find an affordable home

- Many workers are forced to commute longer distances, increasing commuting costs, traffic, and emissions

- Prohibitive housing prices restrict the free movement of workers, which hampers the job market and ultimately restricts economic growth

- Diversity in expensive areas decreases dramatically

- High housing costs exacerbate existing economic inequality concerns

- Marginalized groups – often low-income workers, minorities, immigrants, and the disabled – bear the brunt of

- Housing “booms” (when prices rise) benefit existing homeowners, but make it even more difficult for first-time homebuyers to enter the market

- Efforts to keep rents under control often stifle the development of a new property, which in the long run can only worsen the situation

- Federal tax subsidies, such as the Mortgage Interest Deduction, often disproportionately benefit the wealthy

- A patchwork of federal, state, and local regulations and incentive programs for renters is confusing and difficult to navigate

In short, when housing costs become unaffordable, the effects are severe. Inequality worsens, diversity decreases, and the economy is hampered by a restricted job market.

The problems are clear – but what’s the solution? Below, find a list of current resources, as well as some thoughts on the future of affordable housing, and how policy can improve the situation for Americans.

Affordable housing resources for renters

For renters in the United States, there are a variety of housing programs and resources to explore. Most apply to low-income and moderate-income households, and the majority are operated by the U.S. Department of Housing and Urban Development (HUD).

While the HUD develops these programs and provides federal funding, most programs are actually administered by local Housing Authorities (HAs), or Public Housing Agencies (PHAs). The HUD maintains a directory of these local agencies – in most cases, you’ll want to search for the office closest to you, and connect with them to determine your eligibility and explore your options. You may also wish to connect with a Housing Counselor, who can help walk you through the process.

How to apply for rental assistance programs

All of the programs listed below are managed by Public Housing Agencies or local Housing Authorities. To apply for any program, you’ll first need to contact your local agency.

Agency staff can help you determine if you are eligible for any assistance programs. If you are, you can apply for assistance. You will generally need to provide information such as:

- A list of household members, ages, sex, etc.

- Your household income

- Your employer

- Bank details

- Photo ID

- Birth certificates

- Tax returns for income verification

The application process differs for each program. You’ll first need to connect with your local agency, and they can walk you through the process.

Here is an overview of some of the most notable renter-assistance programs:

Privately-owned subsidized housing

Owners of apartment complexes and other rental properties can receive subsidies through HUD, in exchange for offering affordable units to low-income renters. You can search for properties in this subsidy program here. In most cases, tenants will need to apply directly with the owner or management company of the property itself.

Rents will generally be substantially lower than the market rate. And because the subsidies are paid directly by HUD to the owners, there are no vouchers to deal with on the tenant’s end. The downside is that there are often not many housing units available in this program, due to a lack of funding. Still, it’s worth searching for subsidized housing in your area.

Check out our roundup of the Best Property Management Software

Housing choice vouchers (Section 8)

The Housing Choice Vouchers program, also called Section 8, applies to very low-income families, as well as the elderly and disabled Americans. Households can apply for Section 8 assistance, and if approved, they can receive a voucher to help with rent. The amount of the voucher is based on income, as well as housing costs in your area.

Under this program, tenants search for their own housing. They can rent apartments, townhomes, and other units, so long as they meet program requirements. The voucher is given to the landlord, and HUD funding covers the portion of rent that the voucher includes. The remaining rental cost is the responsibility of the renter to pay.

This program allows for a lot more choice, as it does not restrict renters to specific properties. The voucher amount is also calculated based on median income and rental costs in the specific area, meaning that the subsidy amounts can be higher for more expensive areas. The downside is that the program is consistently under-funded, so often the number of eligible applicants far exceeds the number of available vouchers. There are often wait-lists to enter the program. That said, it’s worthwhile to apply with your local Housing Authority.

Public housing

Public Housing is a program available to eligible low-income families, the elderly, and persons with disabilities. In this program, the government itself owns the housing and makes it available to eligible families and individuals at discounted (or sometimes free) rental rates. Public housing includes apartment complexes, single-family homes, and more.

Public Housing is administered by local Housing Authorities. The program is substantial, with over 1.2 million households currently living in public housing. To apply for public housing, contact your local Housing Authority or Public Housing Agency to discuss your housing needs and eligibility.

State & local programs

HUD-run programs make up the majority of rental assistance programs in the United States. However, there are also some state-run programs, as well as city and county-run programs. It’s worth researching programs in your area, or connecting with a local Housing Authority, to discuss your options. The HUD website also maintains a directory of local programs for renters.

Affordable housing resources for home buyers

The majority of affordable housing programs are aimed at renters, rather than homeowners. However, there are still a variety of programs designed to help make homeownership more approachable for low- and moderate-income households.

The Federal Housing Administration (FHA), which is a part of HUD, offers FHA Loans, a type of subsidized mortgage loan. These mortgages have lower down-payment requirements (as low as 3.5%), lower credit score requirements, and lower closing costs, compared to traditional mortgages. You can search FHA lenders online to connect with one in your area.

Some states and local governments also offer programs of their own. For instance, some states offer interest-free loans to help with initial down-payments. You can search the internet for programs in your area, talk to your local Housing Authority or Housing Counselor, or search HUD’s online database of local programs.

Check out our Complete Guide for First-Time Homebuyers

The future of affordable housing

Currently, America’s patchwork of affordable housing programs is not keeping up with the demand for rental units from low-income renters. Stagnating wages and surging housing prices are exacerbating the problem. This all leads one to wonder: How might we fix the affordable housing crisis in America?

Federal funding

The first and foremost solution is obvious: Policymakers must provide additional funding for existing programs, and for new ones. America’s affordable housing programs are largely successful but are often under-funded for the demand they face.

State & local regulations

Second, much can be done on the state, county, and even city level. Much of this comes down to zoning laws, which regulate land use and the development of new housing. Local zoning regulations are usually put in place to achieve a certain environmental, aesthetic, or safety goal. However, they often exacerbate housing shortages, leading to higher housing costs.

- Exclusionary zoning (a ban on trailer parks, or a mandated minimum lot size, for example) makes it impossible to build affordable housing in expensive areas.

- Inclusionary zoning (a mandate that X% of new development must be low-income housing, for example) can help increase socioeconomic diversity in neighborhoods while reducing the housing cost burden for low-income households.

Local governments can also do a lot to increase the inventory of housing available. This is basic economics: Increase the supply of a product, and prices will usually go down. This intertwines with zoning laws, but it’s important to consider separately.

When a developer wants to build a new property, they must apply for a permit. Depending on the area, they may need to jump through a lot of hoops – or they may not be able to build at all. Many cities try to prevent the building of high-rise complexes, for example, to maintain views for residents. While this may be helpful for current residents, it makes it much harder for new people to move to these cities.

By reducing regulations on new development, cities can increase rental housing inventory, which will eventually lower prices. For a real-world example of this, we can look to Tokyo. In a city of more than 9 million residents, the Japanese government has kept housing prices reasonable by deregulating property development. In essence, this has allowed supply to keep up with demand, keeping housing prices affordable for the average household.

Of course, housing policy is an exceptionally complicated topic. There is no easy “fix”. But if we are to tackle the growing housing affordability crisis facing America today, we must think outside the box. It will take a combination of citizens pressuring their representatives, federal officials allocating additional funding, and local governments altering zoning laws, in order to see meaningful change in the American housing market.