Tax season is nobody’s favorite time of the year: tax preparation can be a complicated process, and making an error on one’s business returns can have serious consequences. Thankfully, there’s a wealth of tax software options that render the whole process significantly less painless for small business owners and independent contractors, at a reasonable cost.

Tax software helps small businesses prepare and file their taxes at a more affordable price than hiring a tax professional like a CPA or EA, making e-filing a great way to save on business expenses. However, tax preparers must be assured that filing is done properly, in order to receive the maximum refund on their income tax returns. We took a look at the choices and reviewed the top 5 tax software providers for 2019. Each choice of tax software has its own strength and will be right for some small businesses but not others. Read on for our full review of tax software for small businesses in 2019, including prices, features, and suitability.

Our top choice: TurboTax

Intuit’s TurboTax may be the priciest tax software of the options we compared, but it also contains the most features and arguably offers the best support. With the three most business friendly packages (Turbotax Self-Employed, TurboTax Live, Turbotax Business) you receive unlimited free chat and phone support. You can even get your tax filing reviewed by a qualified CPA/EA, which means you save money while also getting some of the upsides of professional help.

If you want to try TurboTax for free you can – it costs nothing to get started and you only pay when you’re ready to file.

Our top 5 tax software choices for small businesses

| Tax Software | Who should buy/Affordability |

| TurboTax |

Small businesses willing to pay a little more for top features and support but not wanting to hire a CPA/EA |

| H&R Block |

Small businesses who want high-end tax software at a slightly lower cost than TurboTax |

| TaxSlayer |

A much cheaper option than our top 2 choices, but still with many great features. If you’re a budget conscious small business, this is one tax software to consider. |

| TaxAct |

Another budget option, though a little more expensive than TaxSlayer. It contains many useful features but has a no-nonsense design that stops short of a ‘premium’ experience. |

| Liberty Tax |

Another affordable option that delivers some useful features for small businesses. However, it’s not the strongest on user experience or customer support compared to your other choices. |

How we ranked tax software providers

We ranked the tax software we reviewed based on the following 4 key criteria:

- Features – What do you get with tax preparation software? The more useful features a tax software provider offered, the higher the score.

- Price – Costs matter when you’re looking to save money, especially because one of the reasons to use tax software is that it’s cheaper than an EA/CPA. However, we considered value per feature, not just overall cost.

- Customer and Tax Support – Tax forms are complicated, and sometimes even the best software breaks down or leaves filers with questions. At these times, access to support makes a huge difference. We also scored tax software higher for premium added support features like audit support and tax defense.

- User Experience – You want to get your taxes done. If the tax software made doing that quick and simple, we gave it extra points. Flashy graphics are great, but we looked for things like ease of use, a clear interface, automation, and access to support.

Best tax software for small businesses: TurboTax

Small businesses want tax software that offers everything they need to prepare and file their tax returns quickly and at a fair price. TurboTax delivers exactly that. When it came to the range of features available, the overall price for those features, as well as the excellent support and user experience, TurboTax came out ahead of other competing tax software providers.

TurboTax features

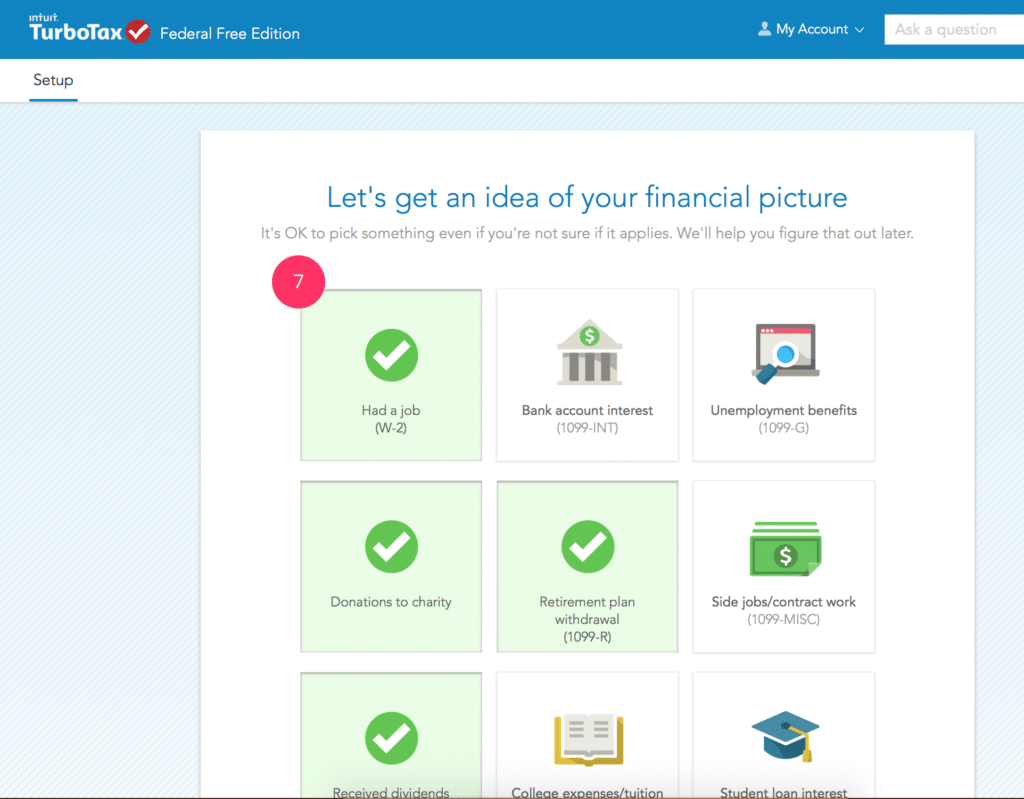

As with all tax software providers we looked at, the exact features you get vary depending upon the package you select. More features come with a higher price tag, but if you’re just filing a simple return – with a 1040EZ or 1040A, for example – then even the Free Edition will offer you enough features to file your return accurately and quickly. However, we’re interested in tax software for small businesses, so we’ll be focussing on the Self-Employed and TurboTax Live packages.

TurboTax is great because it suggests business friendly deductions (useful for making the most of things like home office or vehicle tax deductions) and you can enter multiple sources of income with ease.

TurboTax offers the core features you expect of high-end tax software. You can take a photo of or scan your W-2 and upload it., and import files directly from Quickbooks. TurboTax will extract the information it needs automatically, saving you from having to input all the details manually (eliminating a lot of potential errors). You also get excellent support, and the deduction suggestions and review from CPA/EA are comparable to actual tax advice.

With the addition of tax defense and audit support, TurboTax takes a lot of hassle and stress out of online tax filing and preparation.

Cost of TurboTax

TurboTax isn’t the cheapest option available, and includes additional fees for state and federal taxes, but we believe it still represents excellent value. You should always double check the price for the package you’re interested in on the company’s website, but at the time of writing here’s how the different packages compared:

| Free Edition |

|

| Deluxe |

|

| Premier |

|

| Self-Employed |

|

| TurboTax Live |

|

TurboTax: What’s not included?

If you go for one of the lower packages, you won’t get access to the high-end support features like a review with CPA/EA. Pay attention to the features in your specific package when you buy. Otherwise, TurboTax is an extremely comprehensive tax software.

See the full review of TurboTax here.

H&R Block: Strong tax software for small businesses

While TurboTax is an excellent option, H&R Block also did extremely well in our evaluation. H&R Block includes many of the same features as TurboTax, sometimes including some premium features in their more budget-friendly packages. While the customer support isn’t always as efficient as TurboTax, it’s still good and the overall user experience is comparable.

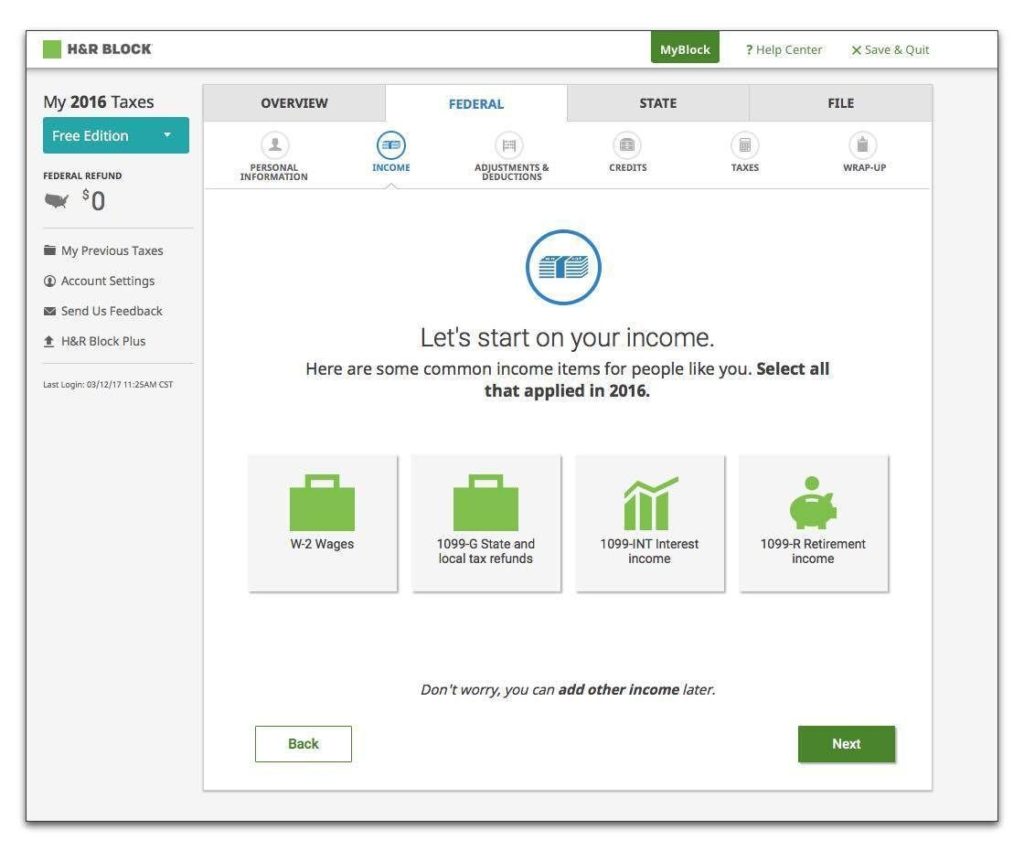

H&R Block features

H&R Block offers the full range of features you’d expect from a premium tax software provider. You can upload your W-2 by taking a photo or scanning, store your information in the cloud, work between multiple devices, and get suggestions and advice on things like deductions. The ‘semi-guided’ user interface is easy to navigate, and the Q&A format is extremely useful for making quick progress.

Cost of H&R Block

Overall, H&R Block tends to be a little cheaper than TurboTax when comparing equivalent packages. The free version also includes more, such as free state tax prep and filing. H&R Block also includes many ‘premium’ features in their less costly selections. Be sure to check H&R Block’s website for their latest prices and features.

| Free |

|

| Deluxe |

|

| Premium |

|

| Self-Employed |

|

H&R Block: What’s not included?

As with a lot of tax software providers, it’s extra to file for state taxes. Audit support is also $19.99 extra.

See the full review of H&R Block here.

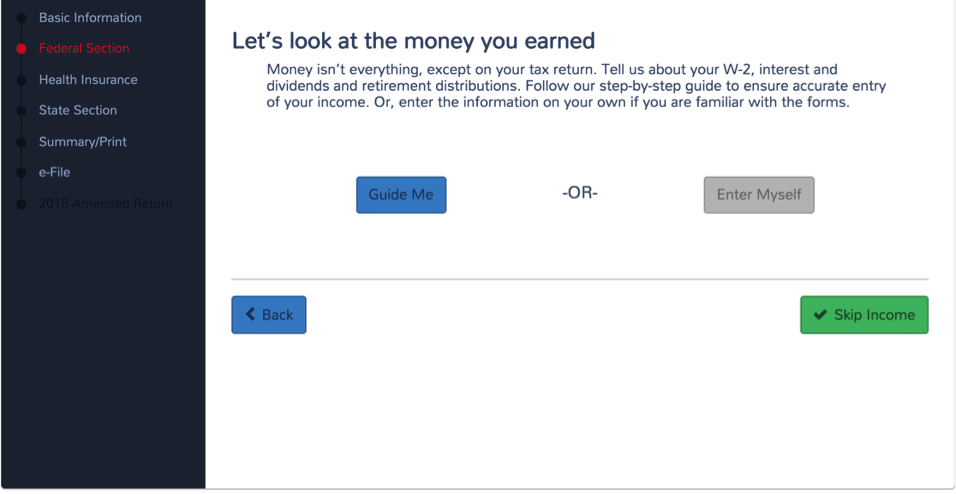

TaxSlayer: Economical tax software

TaxSlayer features

Although it’s not a high-end piece of tax software like TurboTax or H&R Block, TaxSlayer still offers many of the same features. For example, you can upload your W-2, saving you from having to manually input the information. With the packages of interest to small business owners and the self-employed, you get ‘VIP Support’ and a ‘Personal Tax Expert’ to help you get the most out of your tax software. There are also excellent tools to help you identify potential deductions.

Cost of TaxSlayer

TaxSlayer is a highly affordable option despite offering many premium features and a high-quality user experience. For the latest packages and price information, see the company website.

| Simply Free |

|

| Classic |

|

| Premium |

|

| Self-Employed |

|

TaxSlayer: What’s not included?

While TaxSlayer Premium and Self-Employed feature audit assistance (TaxSlayer provides guidance on preparing for your audit) this isn’t included in the lower price-plans. You’ll have to pay an extra $29.99 if you want to add it to a cheaper plan. It’s important to remember that you won’t qualify for audit assistance if you’re filing a Schedule C or if you’re a freelancer.

See the full review of TaxSlayer here.

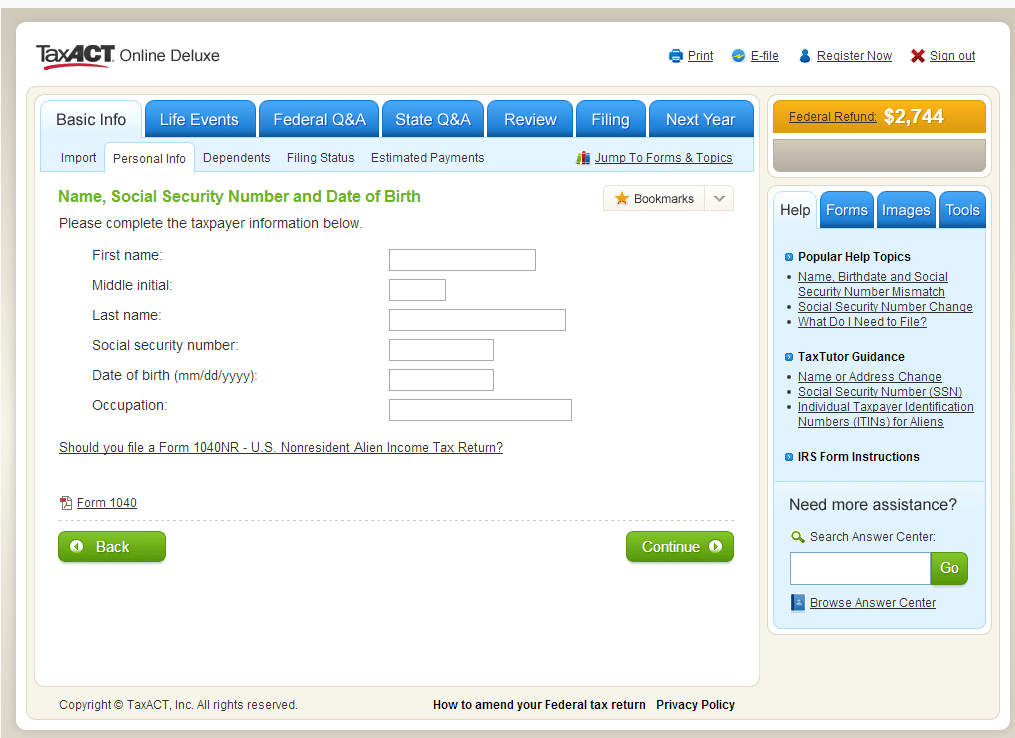

TaxAct: Cheaper alternative to premium tax software

TaxAct is aimed at the budget-conscious end of the tax software market. However, it’s a little pricier than its rival, TaxSlayer, and has a less impressive user interface and experience. That said, it will still help you get your taxes prepared and filed with little hassle.

TaxAct features

TaxAct’s features are similar to their competitors, but in a slightly less beautiful package. However, their biggest selling point is the inclusion of Audit Defense in their top package. This is a valuable extra service, and it means that TaxAct will both help your prepare for your audit and represent you before the IRS.

Cost of TaxAct

Given the features, TaxAct represents good value for money. Small businesses considering using TaxAct should check the company page for their latest plans and features.

| Free |

|

| Basic |

|

| Plus |

|

| Freelancer |

|

| Premium |

|

TaxAct: What’s not included?

If you contact TaxAct’s CPA’s or EA’s, they’ll be able to provide you with ‘tax support’ but not ‘tax advice’. This means TaxAct can help you know what you need to do to go through the preparation and filing process correctly, but won’t offer you advice from a professional on how to keep your tax bill down.

Remember that filing for state taxes is always extra with TaxAct, regardless of the version you use.

See the full review of TaxtAct here.

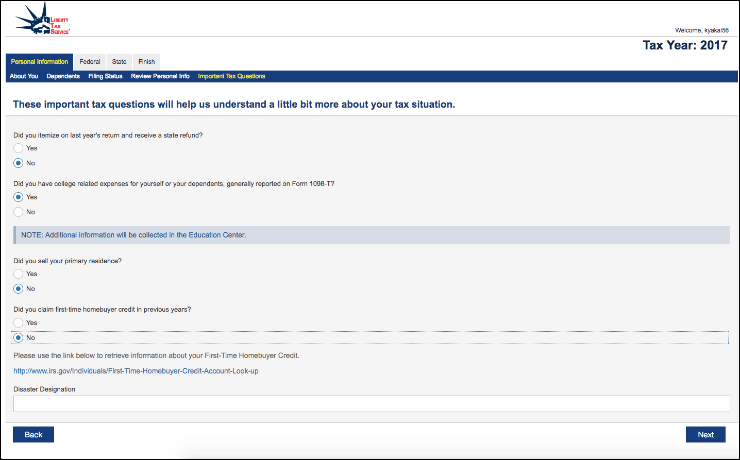

Liberty Tax: Small business tax software on a budget

Liberty Tax is cheaper than options like TurboTax or H&R Block, but it’s on the pricier side of budget tax software. The user experience is less-than-perfect too, and the absence of audit defence or a free option makes Liberty Tax a less attractive option in a competitive field of tax software providers.

Liberty Tax features

While Liberty Tax interface is usable but unspectacular compared to top-tier products like TurboTax and H&R Block or even rival affordable options, such as TaxAct or TaxSlayer. That said, it’s functional.

Using Liberty Tax is straightforward, and going through the initial basic information is made simple by a respectable system of floating sections with autofills. Uploading your W-2 directly also helps, though this is far from unique to Liberty Tax.

Cost of Liberty Tax

Liberty Tax is affordable, but there’s no free option. Small businesses should consider the Premium option. Double check prices and packages on the company website.

| Basic |

|

| Deluxe |

|

| Premium |

|

Liberty Tax: What’s not included?

As mentioned above, you will have to pay extra for audit assistance ($14.95) and Liberty Tax don’t offer audit defence (audit protection consists mostly of guidance). As always. state taxes cost extra

See the full review of Liberty Tax here.

Tax software for small businesses: The final judgment

If you run a small business and you’re choosing between different tax software providers, it’s important to have all the information before you make a final decision. We’ve looked at our top 5 tax software companies, each with different strengths. In our view, TurboTax offers the best combination of features for small businesses at a reasonable price. It’s also free to get started, so there’s no reason not to try it out for yourself.

However, if it still seems too pricey for you, H&R Block and TaxSlayer are both excellent alternatives, though TaxSlayer is clearly the cheaper of the two and H&R Block offers more features.