Taxes can be scary, and small businesses and freelancers often struggle to get them right unassisted. Tax software can help those without costly accountants get their taxes right, avoid trouble with the IRS, and save money.

Summary

TaxAct is cheaper than it’s main competitors such as H&R Block and TurboTax while containing many of the same features. The relatively low price is also appealing. If you’re confident on a computer and don’t expect beautiful graphics and chatbots, TaxAct is a great option. It’s certainly easier than filing without tax software if you’re a small business.

How much does TaxAct cost?

Like its competitors, TaxAct offers a choice of packages depending on business needs, each at different price points. Small businesses might want to focus primarily on their upper-tier products.

TaxAct starts out with a free option, but it’s only for people filing a 1040EZ and state return. As with most tax software, filing for state taxes costs extra, even with the free version ($17 with TaxAct).

However, small businesses will want to consider the higher-tier options such as Plus, Freelancer, and Premium. These range from $39.95 for just federal taxes with Plus, up to $109.95 for both federal and state taxes with the Premium plan. Compared to the market leader – TurboTax – who charges up to $199.99, this is a meaningful saving.

Only you know the specific range of features you require. However, given the potential returns when you properly consider the deductions you can make, the reduction in hassle, and the security that comes from running the potentially complex taxes of a business through a system designed to improve the accuracy of your return, you can see the upsides of investing in one of TaxAct’s higher level packages.

Check out our roundup of the Best Tax Accounting Software

TaxAct features

Your tax return could be considerably more complicated if you run a small business. The difference between a simple tax filing as an employee and self-employment or even becoming an employer can be a shock to those just starting out. As a result, you may find the features of TaxAct extremely valuable.

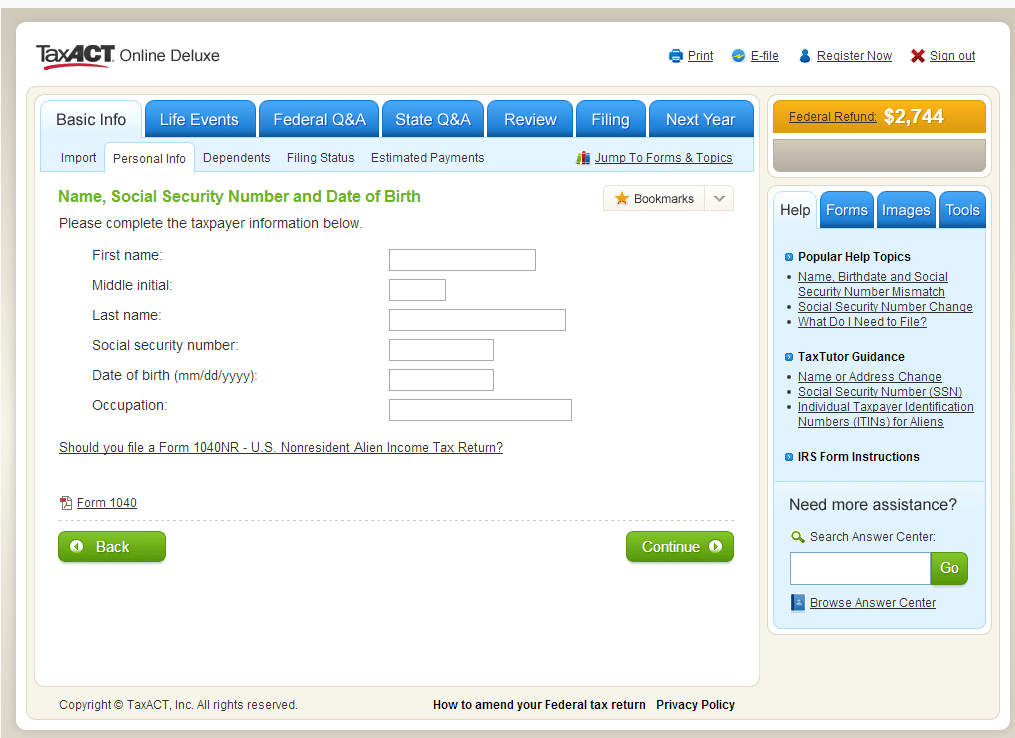

TaxAct is less beautified than other tax software, and it’s clear that flashy design is less of a priority for them. However, that doesn’t mean it doesn’t work well. Although no-nonsense, the design is clear and it’s fairly easy to navigate around.

There’s nothing revolutionary about TaxAct compared to other tax software. They’re mainly competing on price. However, if you’re content with just a little less guidance and are somewhat computer literate, you’ll find accessing the range of features below simple enough.

Always select your plan based on the features that you want. (Check TaxAct’s website for up-to-date pricing.)

TaxAct packages and pricing

| Free |

|

| Basic |

|

| Plus |

|

| Freelancer |

|

| Premium |

|

Looking at the range of features incorporated into TaxAct, at first glance they look like a front runner considering their low price point. However, while many of the features work fine, they’re not as streamlined as those you’ll receive from more expensive competitors like H&R Block or TurboTax.

For example, although you receive many of the same features – such as uploading a W-2 with a photo, completing your return across multiple devices, and so on – they’re usually not quite as streamlined or well-integrated as you’ll find with their high-end competitors. On the plus side, they still work well and get the job done.

Perhaps TaxAct’s biggest advantage relative to their more expensive rivals is the inclusion of Audit Defense into their premium package. For other companies this is usually an optional extra you pay more for on top of the headline price for even the most expensive package. However, TaxAct includes this valuable service in Premium, which can be a real help in the unlikely (but possible) event that you’re audited by the IRS.

Does TaxAct have customer support?

TaxAct does come with fairly comprehensive customer support, and you can usually reach someone by online chat fairly quickly. However, as you’d expect with a cheaper product, the service isn’t quite as snappy or wide-ranging as you might receive from a pricier competitor.

If you’re fairly computer literate, you may find you don’t need any help. The user interface is fairly simple, but if you’re not confident with IT systems you may find yourself more comfortable going through it with someone who is or simply opting for flashier, high-end tax software.

As already noted, Audit Defense comes with the Premium package that we’d recommend for small businesses. However, you can get it as an add on with a lower package. Of course, as your chances of being audited increase based on the complexity of your tax return, you’ll probably find that if your requirements are simple enough for a lower package to handle, you likely won’t need Audit Defense at all (but there are always exceptions). With Audit Defense, TaxAt will help you through the audit process, which can be invaluable in this potentially frightening and time-consuming situation.

What’s not included?

We’ve already seen that Audit Defence is extra if you don’t opt for the Premium package.

Regarding customer support, TaxAct seems to be moving away from email. While it’s possible to get hold of them via email, you’ll find it far easier to contact them via phone or online chat.

It’s crucial to note that if you contact customer support and speak to one of the (excellent) CPA’s or EA’s, they’ll be able to provide you with ‘tax support’ rather than ‘tax advice’. This is an important distinction, but it boils down to TaxAct helping you know what you need to do to go through the process correctly, rather than offering you advice from a tax professional on how to keep your tax bill down.

It’s also worth remembering that filing for state taxes is always extra, regardless of the version you use.